Table of Contents

This page provides regularly updated information on Paycheck Protection Program (PPP) forgiveness and is based on emails originally shared with Wizehire customers.

Apply for a PPP loan from your Wizehire Dashboard.

February 26, 2021

The White House announced that from February 24 – March 10 Paycheck Protection Program loan applications will be open exclusively to small businesses with fewer than 20 employees and non-profit organizations. More provisions have also been enacted in order to prioritize underserved small businesses. Including:- Providing one-person businesses and/or sole proprietors access to PPP loans during this 2-week period

- Removing barriers that prevented some small businesses from applying for a PPP loan before including prior non-fraud felony convictions and student loan debt

- Allowing non-US citizens who are legal US residents to apply for a PPP loan with their Individual Taxpayer Identification Number (ITIN)

January 18, 2021 The Paycheck Protection Program will open to everyone on Tuesday, January 19, allowing all small businesses, regardless if you’ve already received a loan or not, to gain access to available funds. If you’re looking for a lender, we recommend our friends at Cross River Bank. They share our mission to give small businesses the best tools and resources they need to thrive. They were a top lender during the first few rounds of PPP, and have provided nearly 200,000 loans, mostly to businesses with fewer than 10 employees. Here’s what you need to know:

If you’re applying for a PPP loan for the first time:

- Fill out Form 2483 – First Draw Borrower Application

- Submit tax Form 941

- Submit state quarterly wage unemployment insurance tax reporting forms for every quarter in 2019 or 2020 (whichever you used to calculate payroll) OR payroll processor records

- Submit evidence of retirement and/or employee group health, dental, life, disability, or vision insurance contributions (if your business provides it)

- Submit evidence that your business was operating on February 15, 2020

- If your business is a partnership, you’ll also need to submit IRS Form 1065 K-1s

- If you are self-employed in addition to having employees, you’ll also need to submit IRS Form 1040 Schedule C

If you’re applying for a PPP loan for the second time:

If you’re using the year 2019 to calculate payroll AND you’re using the same lender this time around, you’re in luck. The final ruling on the Interim Final Rule on Second Draw Loans states that you don’t have to submit the same documentation twice if you already submitted these forms before to the same lender. You just have to fill out the application form. If you’re using a different lender or using the year 2020 to calculate payroll, you’ll need to submit the following:- Fill out this form: Form 2483-SD – Second Draw Borrower Application

- Submit tax Form 941

- Submit state quarterly wage unemployment insurance tax reporting forms for every quarter in 2019 or 2020 (whichever you used to calculate payroll) OR payroll processor records

- Submit evidence of retirement and/or employee group health, dental, life, disability, or vision insurance contributions (if your business provides it)

- Supply supporting documents that show a 25% decline in gross receipts in any quarter in 2020 compared to the same quarter in 2019. (Relevant tax forms, annual tax forms, or even quarterly financial statements or bank statements can be used for this.)

- Evidence that your business was operating on February 15, 2020

- If your business is a partnership, you’ll also need to submit IRS Form 1065 K-1s

- If you are self-employed in addition to having employees, you’ll also need to submit IRS Form 1040 Schedule C

January 11, 2021 The Paycheck Protection Program officially reopens today, giving thousands of small businesses access to much-needed funds to support operations, purchase resources, and pay their employees. However, the program isn’t open to every small business today. Here’s what you need to know.

- The Small Business Administration is currently only accepting “first-draw” loans. That means if you have already received a PPP loan, you can’t apply for another one just yet.

- The portal will only accept applications from Minority Depository Institutions (MDIs), Community Development Financial Institutions (CDFIs), or other community lenders that serve underserved borrowers.

What You Need to Know About MDIs

You can qualify for an MDI if:- 51% of your voting stock is owned by minority individuals who are US citizens or residents OR

- if the majority of the Board of Directors is made up of minority individuals and the business serves a predominantly minority population.

What You Need to Know about CDFIs

CDFIs provide affordable financial services to low-income and disadvantaged communities. If your business falls in this category, you can find a lender in your area with this spreadsheet put together by our friends at Gusto. This sheet will also tell you whether or not that lender participated in the first round of PPP loan funding (although that’s no guarantee they’ll participate a second time.) You can also use this CDFI locator. You can also use the Small Business Administration’s free Lender Match tool to narrow down your options based on your specific business needs.If you don’t qualify for an MDI or CDFI

Second-draw loans for community lenders will begin on January 13. (Here’s the second-draw application). The portal will open up to all applications shortly after. If you qualify, we highly recommend getting your application in now with a lender who is accepting applications, before the next wave comes through. This is the PPP borrower application form, which tells you how to calculate payroll costs with adjustments for certain types of businesses.- Generally, both first and second-time borrowers can receive a loan that’s up to 2.5 times your average monthly payroll costs (cap per employee of $100,000 annualized) in 2019, 2020 or the year before you applied for the loan.

- Businesses like hotels and restaurants can receive up to 3.5 times on second-draw loans.

December 27, 2020 The President has officially signed the COVID19 Relief Bill. Now is the time to review your information with your accountant as the SBA and Treasury will issue rules and programs within a few weeks.

December, 22, 2020 Congress just passed a COVID-19 relief package that will provide $300 billion in aid to small businesses and it’s making its way to the President’s desk.

Here’s what’s inside and how it may impact your business:

- New tax deductible business expenses: You can deduct business expenses from your taxes if you paid for them with a PPP loan. PPP loans will not count as income.

- Employee retention tax credit extension: Although you’re not required to provide FFCRA (paid sick or medical/extended family leave) leave after January 1, 2021, if you do, you’ll be able to continue to get a federal tax credit through March 31, 2021. The bill also increases the refundable payroll tax credit amount to a maximum of $14,000.(Previously the maximum was only $5,000.)

- $20 billion for Economic Injury Disaster Loan (EIDL) Grants: Additional money has been allocated for small businesses in low-income communities. The maximum grant amount is $50,000. (These, in most cases, do not need to be repaid and are not taxable to you.)

- Pandemic Unemployment Assistance (PUA) program extended: Unemployed workers will now receive a $300/week supplement from December 26, 2020 – March 14, 2021.

Qualifying small businesses will also be eligible to seek a second PPP loan.

While at least 60% of funds must go to payroll costs, there are new covered expenses that may benefit your business:- Software, cloud, and computing resources

- HR and accounting costs

- Property damage from public disturbance not covered by insurance

- Supplier costs

- Purchase of PPE (personal protective equipment)

2nd PPP loan requirements:

- Have used or intend to use the full amount of the first PPP loan

- Have fewer than 300 employees

- Can show a 25% gross decline in receipts in any quarter in 2020 compared to the same quarter in 2019. (You can use this simple calculation tool to determine the amount).

What you need to know about applying for a second PPP loan:

- If you received a PPP loan more than 90 days ago: Additional loans cannot exceed $2 million per borrower (as opposed to the previous $10 million).

- If you received a PPP loan within the last 90 days: The combined total of the new and old loan should not exceed $10 million.

What you need to know about applying for forgiveness:

For PPP loan amounts under $150,000: You just have to fill out a one-page application form. For PPP loan amounts between $150,000 – $2 million: You’ll need to submit the following:- All relevant employment records for 4 years following your application submission

- All supporting documents for 3 years following your application submission

- Any form related to (you) the borrower’s demographic information

October 21, 2020 The Small Business Administration announced that companies that received a PPP Loan for less than $50,000 (70% of PPP loan recipients) are eligible to use Form 3508S to file for streamlined loan forgiveness. You can use this form without a reduction in loan amount even if you:

- Reduced your number of full-time employees

- Reduced your employees’ salaries or wages

- The 7 total certifications that you, the borrower, must verify

- A document including all payroll and non-payroll related expenses

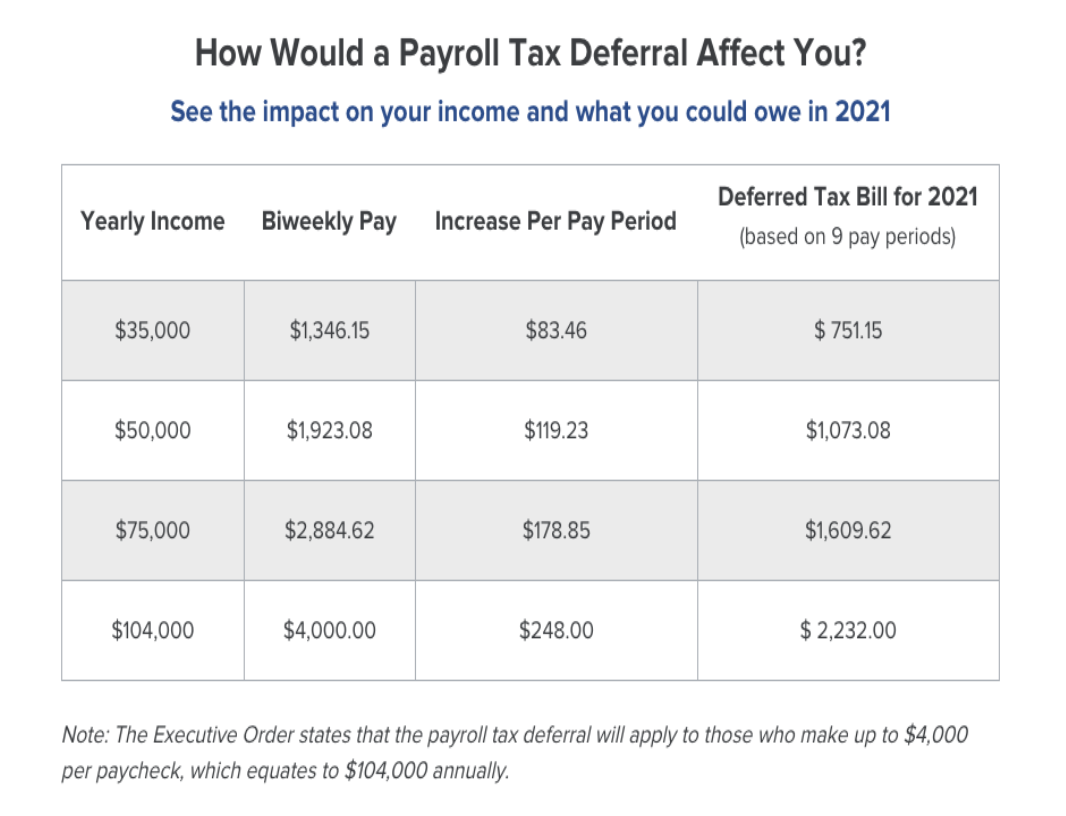

August 31, 2020 30 leading industry organizations, including the NAR and US Chamber of Commerce, advise employers to continue withholding payroll taxes due to future employee tax liabilities. The US Chamber created an impact analysis chart (shown below) explaining that while employees would get a small benefit check this year, those who make under $104,000, would owe much more next year. For example, according to the groups, a $104,000 salary would increase a bi-weekly payment by $248, but the tax owed in 2021 would potentially be $2,232.

In a letter to Congress and the US Treasury, these organizations encouraged collaboration and a path forward to provide tax relief to Americans without the imposition of a large future tax bill.

The new withholdings rules go into effect September 1. Read the full letter and a press release from the US Chamber of Commerce here.

In a letter to Congress and the US Treasury, these organizations encouraged collaboration and a path forward to provide tax relief to Americans without the imposition of a large future tax bill.

The new withholdings rules go into effect September 1. Read the full letter and a press release from the US Chamber of Commerce here.

July 8, 2020: The President has signed the Paycheck Protection Program extension bill, allowing small business owners until August 8 to apply for a PPP loan. Here’s what we know right now:

- There’s still about $130 billion left in PPP funding

- If you haven’t applied yet, there’s a new “EZ application” (3508EZ) you can fill out to apply for loan forgiveness. Any borrowers who didn’t reduce salaries or wages by more than 25% or have no employees (instead they hire contractors or sole proprietors, for example) can use this form.

- If you applied for a loan but never heard back, but believe you’re still eligible, it’s not too late to apply through a different lender.

June 5, 2020: The President has signed the Paycheck Protection Program Flexibility Act into law. Small businesses that received a PPP loan will now have more time to pay it back and be able to spend more of the proceeds on operations. Here’s what you need to know:

- Available funds for expenses other than payroll through a PPP loan have increased from 25% to 40%. (However, the money must still go toward one of the following: rent, mortgage, payments, utilities, and loan interest.)

- The time to pay back the loan has increased from 8 weeks to 24 weeks. (But you can still apply after 8 weeks, if you want to.)

- For funds that are not forgiven, the time to pay the unforgiving loan amount has increased from 2 years to 5 years.

- The June 30, 2020 deadline to rehire works for their salaries to count toward forgiveness has been pushed back to December 31, 2020.

- You’re unable to hire someone who was an employee on or before February 15, 2020.

- You can prove you’ve been unable to hire similarly qualified employees by December 31, 2020.

- You can prove you’ve been unable to return to a similar level of business activity as operations were on or before February 15, 2020.

June 3, 2020: The Paycheck Protection Program Flexibility Act just passed in the Senate and is now on its way to the President’s desk.

May 29, 2020: As May wraps up, demand for PPP loans has slowed and roughly $140 billion in funding remains from the 2nd round. According to the Census Bureau, 75% of businesses have requested PPP loans and 70% have received funding. Now, the focus has shifted to how more small businesses can take advantage of the program. The House recently passed the Paycheck Protection Program Flexibility Act, which would ease restrictions and forgiveness rules and allow businesses more time to use the loan and spend more of the proceeds on operations. The bill now moves to the Senate where we hope it will pass next week.

Here’s a breakdown of the planned changes:

- Reduce the minimum amount that must be spent on payroll from 75% to 60%. This would allow up to 40% to be spent on rent, utilities, and other operating expenses.

- Increase the timeline to spend PPP loan funding from 8 weeks to 24 weeks, giving more businesses time to return to work and rehire.

- In the event funds are not forgiven, increase the repayment timeline from two years to five years.

May 4, 2020: The SBA resumed accepting applications for PPP Loans last Monday, April 27. In the first week of this 2nd round, 2.2 million loans were processed, providing small businesses with $175 billion in funding. With more than half of the second round dollars already allocated, funding is likely to run out this week. If you’ve been unable to apply for a PPP loan through a national bank, I continue to recommend your local lenders as the best choice. Forbes has also put together a list of non-bank and alternative lenders worth considering.

April 24th, 2020: Earlier today, an expansion to the PPP was signed into law, replenishing the program with $310 billion. The law also brings an additional $60 billion for the Economic Injury Disaster Loan program. With this added funding, the SBA will be able to continue processing PPP loan applications on a first-come, first-served basis. If you haven’t submitted an application yet, Gusto has put together an updated list of lenders currently accepting applications.

April 16th, 2020: PPP loan funding ran out this morning and Congress continues to negotiate an additional $250B in funding. If you did not hear back on your loan, we recommend reaching out to your legislators to share your story by either calling (202) 224-3121 or using the Find Your Representative website: https://www.house.gov/representatives/find-your-representative

April 10th, 2020: I’ve been talking to a lot of business owners about their PPP experiences and I’m hearing the same things: a small percentage are getting funding so far (typically from smaller, local banks), while many are stuck waiting, and for a few, big banks are turning customers away.

If your current bank will not accept your application, I want to share two lenders that we’ve confirmed are accepting and processing loans from non-customers:

- Fundera: https://www.fundera.com/

- Cross River Bank: https://crossrivers.com/

Additionally, here’s a list of some smaller banks are worth exploring: https://smartasset.com/insights/ppp-loan-lenders (The ones noted with ** are already taking applications from non-customers).

Important: If you’ve already applied for a loan but haven’t been approved yet, don’t apply again. The SBA outlines this and other questions in a new FAQ. Only apply again if your current lender has pushed you to do so.April 2nd, 2020:

From one business owner to another, I wanted to make sure you’re prepared so you can benefit from the small business relief programs available starting April 3rd, through the recently passed CARES Act.

In my opinion, the most critical element of this law for small businesses is the $349 billion set aside for the Paycheck Protection Program (PPP). This program is separate from the disaster loan program I mentioned two weeks back.

The PPP works through the Small Business Administration in partnership with local banks to ensure companies like yours have the necessary capital to maintain operations and retain your people—through emergency loans that are ultimately forgiven.

This program is being launched at a rapid pace. Someone at your bank is likely working tonight to ensure things go smoothly.

I highly encourage you to evaluate this program for your business and contact your bank. The SBA is anticipating running out of funds within two weeks of the application opening. Time is of the essence.

If you haven’t researched the program yet, I wanted to share the latest resources with you:

- The US Chamber of Commerce put together a great guide on the program outlining how to qualify, what lenders will require, how much you may borrow, and what is forgiven.

- The PPP will work through existing bank programs, however not every bank will accept applications on April 3rd. The SBA provides a lender matching tool to help businesses find lenders. If you do not already have a banker with an existing SBA program in mind, use this list to find options.

- Yesterday, the Treasury provided a sample application form. It may change by tomorrow, but one thing is clear: it is about as simple as government forms can be. Your lender of choice will likely use a very similar application form.

If you choose to apply, you’ll need the following payroll documents:

- Every employee’s W-2 for 2019 and when applicable, Form W-2 C

- All 4 quarterly-filed Form 941 due to IRS within 30 days following quarter-end

- Annual IRS Form 940 due to IRS by January 31

- Each independent contractor’s 1099

- All 4 quarterly-filed Form 1040-ES for self-employed individuals

- The 2019 YTD detail of payroll paid (if you use a third-party tax service)